All About Mandatory GST E-Invoicing in India from 1 October for Businesses

In an effort to further plug income leaks and ensure improved tax compliance from corporations, the Central Board of Direct taxes (CBDT) has made E-Invoicing in India compulsory for businesses with annual revenues surpassing Rs 10 crore from October 1. According to the centre, the norm regarding council suggestions has been changed. Currently, companies having yearly revenue of more than Rs 20 crore are required to use GST e-invoices.

Beginning on

October 1, 2020, businesses with a

turnover of more than Rs 500 crore

were included in the scope of e-invoicing in India for

business-to-business (B2B) transactions. Businesses in the second phase were

required to start issuing e-invoices from January 1, 2021, if their annual revenue exceeded Rs 100 crore. From April 1,

2021, businesses having a turnover of more than Rs 50 crore were required to generate e-invoices. With effect from April 1, 2022, enterprises with annual

revenues above Rs. 20 crore are

using GST e-invoicing in India.

According to

officials, e-invoicing in India would be required for companies with a Rs 5 crore in annual revenue by the

next year.

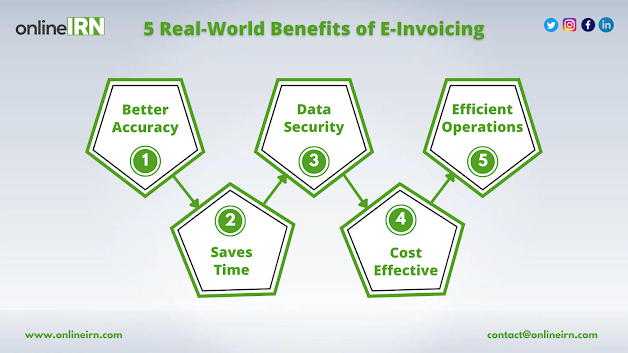

What Effects or Changes will E-Invoicing have on Business Operations?

Businesses

must now connect their systems with the government's invoice registration

portal in order for every B2B invoice to automatically generate an Invoice

Reference Number (IRN). To comply with the e-invoice standard, they will also

need to make adjustments to their accounting software. The following business

processes will be impacted by the creation of e-invoices:

1. Businesses

must choose whether to comply with e-invoicing requirements through API

integration, offline tools or GSP integration (GST Suvidha Provider).

2. The company

will now need to determine which transactions may be subject to e-invoicing and

separate them properly for compliance.

3. Businesses

must keep a vendor and customer database to include extra information on

invoices, such as bank information and payee information.

4. Since B2B

supplies can be automatically filled out in the returns while B2C supplies must

be manually updated, businesses will need to make modifications to how they

prepare GST returns.

5. Engaging in

the ongoing generation and capture of IRNs will be the key challenge

for businesses. Each day, large retailers produce tens of thousands of B2B

invoices. The consumers cannot be made to wait until the e-invoice is

generated. These companies must use GSP's services for a seamless rollout.

What If No E-Invoice is Generated?

Non-generation

of an e-invoice is a crime punishable by law. It carries a fine of up to

Rs.10,000 per invoice. In addition, erroneous invoicing might result in a

Rs.25,000 penalty each invoice.

Aside from

criminal restrictions, if a taxpayer fails to generate an e-invoice-

·

The GST returns will not be automatically filled out.

·

Customers will be unable to claim validated ITC.

·

Customers can refuse to accept an invoice that doesn't meet the

requirements for e-invoicing.

Preparation for the Adoption of E-Invoices

India is a

new market for e-invoices. Therefore, companies will need to take the following

actions to ensure a smooth transition to e-invoicing in India:

·

Choosing the

Most Effective ERP Integration

API-based

and SFTP-based interfaces are the most frequent for e-invoice generation. The

integration may be chosen by an organization based on its budget and specific

business requirements.

·

Modifications

to the Accounting Software

For the

purpose of generating IRNs, businesses will need to reconfigure their

ERP/accounting software to interface with the IRP portal. Additionally, the

printing infrastructure will need to be modified to include new features like

QR codes. Such adjustments will demand a large financial commitment.

·

Data

Security

Because

e-invoices are typically created straight from an organization's ERP/accounting

software, data security is critical. This accounting software contains critical

business information. Additionally, if a taxpayer intends to use ASP/GSP

services, employ two-factor authentication that is enabled and ISO 27001

certified.

·

Employee

Education Sessions

Prior to E-Invoicing

in India, businesses generated invoices in standard forms. However,

e-invoicing necessitates that businesses adhere to established formats. This

format is broken down into three sections: e-invoice schema, masters, and

e-invoice template. As a result, they will need to teach their employees in

order to familiarize them with the new regulations.

.png)

Comments

Post a Comment